housing wage

-

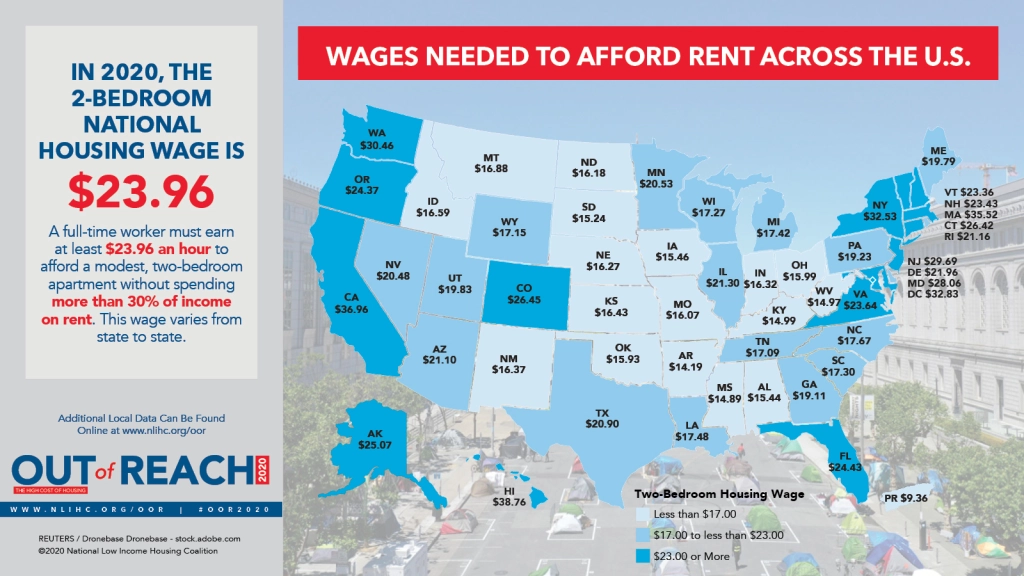

Let’s Talk Housing Wage: Understanding ‘Out of Reach’ 2020

NLIHC published this year’s Out of Reach: The High Cost of Housing report in mid-July. Out of Reach estimates a Housing Wage, the hourly wage a full-time worker must earn to afford modest rental home. Here we provide detailed responses to some FAQs to help readers better understand the report and the need for long-term… Continue reading

-

Twenty-five years after Out of Reach was first published, the housing crisis continues…

A week ago, NLIHC released its annual report, Out of Reach. Out of Reach 2014 provides extensive data on housing costs and wages for every state, county, and metropolitan area in the United States. Over the years, NLIHC has expanded and improved the Out of Reach report; however, the methodology remains the same. Here’s a review… Continue reading

-

News Round-Up: It Takes a Village

It takes a village to raise a family, and it may take assistance from multiple levels of government to ensure affordable housing is available to those who need it. As NLIHC research has shown over the years, some local communities have in place programs and resources to help make up for where the federal government… Continue reading

-

News Round-Up: Sacred Cows

In housing news this week, we found encouraging signs that the conventional wisdom about housing policy might be changing, and continued concern that not enough is being done to end poverty and suffering in our nation. CQ covers a new wrinkle in the tax debate raging in Washington: Willingness to let go of sacred cows.… Continue reading