by Dan Threet, NLIHC research analyst

The Census Bureau released the first wave of results from Phase 2 of their Household Pulse Survey on September 9, and the responses reveal that many renters continue to struggle to afford their housing. The survey, conducted August 19 through August 31, indicates that 15% of renters are behind on paying their rent. Most of those who have fallen behind are low-income renters. A fifth of renters with household incomes below $35,000 are not caught up on rent. Among renters who have experienced loss of employment income, nearly 22% have already fallen behind. If renters experiencing loss of income have been paying the rent using dwindling savings or credit cards, that share may continue to rise.

Renters of color are more likely to be struggling to catch up on rent payments. A greater share of Latino, Black, and Asian renters are behind on their rent (Figure 1). While 11% of white renters are behind, 19% of Asian renters, 20% of Latino renters, and 23% of Black renters are behind. Before the pandemic, people of color were already more likely than white people to be severely housing cost-burdened, paying more than half of their incomes on housing costs, and they were more likely to be extremely low-income renters. Since the economic downturn in the spring, the disparity in employment by race or ethnicity has increased, as Black and Latino workers have been especially hard hit. The Pulse Survey shows that the economic crisis has been particularly harmful to renters of color.

Among renters who reported they were not caught up on rent, 47% said it was very or somewhat likely they would be forced to leave their home in the next two months. A patchwork of local, state, and federal eviction moratoriums prevented this share from being even higher. Most of the renters who expected to be evicted had household incomes below $35,000 (Figure 2). For renters already behind on rent, many will not be able to pay their debts by October. The recent CDC eviction moratorium, in effect until the end of 2020, protects most, but not all, renters from eviction. It does not cover renters struggling to pay their rent before the pandemic who have not experienced a loss of income. Even covered renters, however, will continue to accumulate back rent and late fees, absent sufficient rental assistance. Without this assistance, the nation will likely face a massive eviction crisis at the end of the moratorium.

A substantial share of renters remain uncertain about how they will pay next month’s rent. Twenty-eight percent of renters expressed no confidence or only slight confidence that they could pay on time or indicated they had deferred payment. Unsurprisingly, confidence levels were lower among those with lower household incomes: among renters with household incomes below $35,000, 38% fell into this group. This confidence also varies considerably by race and ethnicity. Whereas 20% of white renters at all income levels expressed no or slight confidence or indicated deferred payment, 31% of Asian renters, 37% of Latino renters, and 38% of Black renters did so.

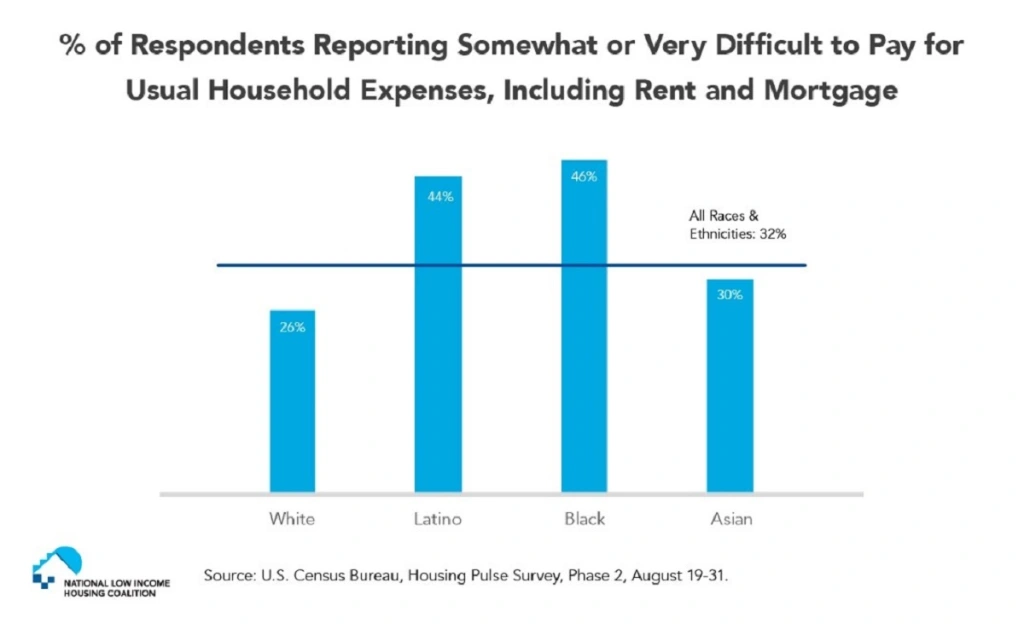

Thirty-two percent of all respondents—including renters and homeowners—found it very or somewhat difficult to pay for their usual household expenses in the prior seven days. These usual expenses include food, rent and mortgage payments, car payments, medical expenses, and student loans, among other things. Over half (54%) of people with household incomes below $35,000 found it very or somewhat difficult to pay for these expenses. Twenty-six percent of white respondents, 30% of Asians, 44% of Latinos, and 46% of Blacks reported it was very or somewhat difficult (Figure 3). If “the rent eats first,” low-income renters who are currently paying their rent may be able to do so only because they are cutting back and struggling to pay for food, medical care, transportation, and other necessities.

There is considerable evidence that the lowest-income renters and many renters of color will continue to struggle in the coming months. Congress needs to pass emergency rental assistance to help these renters pay their bills and prevent an eviction crisis when the CDC moratorium ends at the end of this year. At least $100 billion in emergency rental assistance is needed for at-risk households. This aid will help both households and housing providers meet their financial obligations. The “Emergency Rental Assistance and Rental Market Stabilization Act” and the housing provisions of the HEROES Act would provide such aid. While the CDC eviction moratorium is a welcome development, it needs to be improved to ensure that all renters are protected from evictions for nonpayment of rent while coronavirus continues to pose a threat to public health. The eviction and foreclosure moratorium and other resources in the HEROES Act must be passed immediately to improve on the current policy.

Leave a comment